-

Japanese firm MS&AD acquired 80% of ILS manager Leadenhall Capital Partners in 2019 from another affiliate.

-

As the P&C market shifts, carriers are looking for growth from acquisitions.

-

Founder and CEO of Nascent Andre Perez will join Sephira’s board of directors.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

The business has been ~70% owned by White Mountains since January 2024.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

The leadership’s commentary spotlighted to value of ILS to the group.

-

It is understood that CyberCube has been considering a sale of the business.

-

The Japanese carrier faces integration challenges to make a success of the deal.

-

Aspen Capital Markets earned $169mn in fee income in 2024 alone.

-

The purchase brings Sompo an established ILS platform as part of the deal.

-

The Bermudian firm has an active ILS division, unlike the Japanese conglomerate’s insurance divisions.

-

The transaction is expected to close later this year.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

The deal leaves premier surety as Travelers' sole Canadian portfolio.

-

The reinsurer said the probe concerns the alleged involvement of its former chairman.

-

The acquisition expands its global employee benefits business to ~4,000 global employees.

-

Guernsey’s TISE listed the world’s first private cat bond issued by Solidum Re in 2011.

-

The firm will match segregated accounts of portfolios to investor mandates.

-

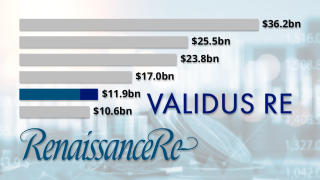

The combined entity ranks third in the Insurance Insider ILS leaderboard.

-

Compressed cat bond spreads could drive some rebalancing, as M&A remains a prospect.

-

The deal comes around three years after Markel sold a controlling interest in Velocity for $181.3mn.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The Swiss-based team of Siglo has transferred to Cambridge Associates.

-

Redington provides services to UK pension funds, wealth managers and institutional investors.

-

The Risk International team will remain in its current location, under Jennifer Gallagher.

-

The denial followed this publication’s report that Covéa had renewed its intentions to buy the reinsurer.

-

The mutual’s approach comes as Scor continues efforts to fight back from performance issues including a flare-up in L&H.

-

The transaction complements its previous acquisition of RMS in 2021.

-

The deal will boost the investment consultancy’s ILS capabilities.

-

Winning higher-fee private ILS mandates will strengthen firms’ negotiating positions.

-

The deal will include Axa IM’s alternatives funds including ILS.

-

The combined Twelve-Securis entity would be a top-five ILS firm currently.

-

Urs Ramseier will be CEO and Herbie Lloyd CIO.

-

The sale is expected to be completed by the end of the year.

-

Sources said that Japanese big-three carrier Sompo and Italian insurance giant Generali are circling.

-

Former Teneo M&A head Alexander Schnieders will lead the unit.

-

The management’s buyback acquisition brings an end to the two-year relationship.

-

GeoVera’s MGAs will sell to SageSure and insurance companies will merge with SafePort.

-

The Lloyd’s legacy business has been placed up for sale, along with other units.

-

The outlook for M&A activity is brighter after 2023 returns.

-

Arm is based in Guernsey and has a Bermudan management licence.

-

The newly launched Marco Re will be led by Mark Elliott as CEO.

-

A non-binding term sheet was signed on October 6, whereby the buyer will acquire 100% of Interboro’s issued and outstanding securities in exchange for cash.

-

BCCL will be rebranded to Nascent Advisory Services Ltd as part of the transaction.

-

-

The private equity firm is targeting $1trn in assets under management for the combined segment.

-

Frontier’s employees, including director and co-founder Peter Brodsky and CEO Derek Winch, will remain in their current roles.

-

The two parametric businesses will be brought together as the UK and German governments sell out.

-

The vehicle will focus on middle-market transactions in the US and Europe across the insurance value chain.

-

The firm has moved to defend its plans against a rival strategy supported by a small group of investors.

-

The carrier has agreed to acquire the former Credit Suisse ILS unit, following the acquisition of sister company Humboldt Re in 2021.

-

Financials Acquisitions Corp is looking to extend its merger deadline and raise “substantial” extra funds.

-

Removing any competitor is a positive for ILS peers in a competitive time for fundraising, but it is not clear how much of a boost this will give RenRe.

-

The takeover will push it up two places to rank as the fifth-largest writer of P&C reinsurance by gross premium.

-

AIG will invest a significant amount into Fontana and DaVinci.

-

The Bermudian reinsurer launched a public offering of 6,300,000 common shares and anticipates raising around $1.15bn to finance the transaction.

-

The deal includes AIG's AlphaCat platform.

-

The AJ Gallagher-owned ILS services provider is expanding its footprint globally.

-

The non-catastrophe ILS platform hit a valuation of $1bn after a Series C funding round.

-

The acquisition gives UK asset manager Liontrust a broader European footprint and cat bond products.

-

Bay Risk will become part of Gallagher Re’s Global Programmes practice group, led by Andrew Moss.

-

The reinsurer said in its Q4 earnings call that Argo’s takeover further diversifies its operations and adds a foundational piece to its expanding P&C activity in the US.

-

The international reinsurance unit booked almost EUR1bn in revenue in 2022.

-

-

Bowood managing director Stephen Greener will chair the entity, which is to place $6bn in GWP.

-

Vesttoo's aim for the partnership is to bridge the gap between the insurance and capital markets, scaling insurance-linked investments as a source for reinsurance capacity.

-

The acquisition will enable the Japanese carrier to expand further into the US and across a host of insurance lines, including property and marine.

-

There is no guarantee that the process will yield a particular transaction.

-

The former Chubb exec will remain on the board as an independent director, along with president and CEO Jacques Bonneau.

-

The French mutual’s CEO Thierry Derez and chief of staff Sylvestre Frezal said the deal is a strategic move to adapt to new forms of risk.

-

Kiln and UPC partnered to form the insurer in 2018, but it was merged into American Coastal earlier this year

-

FedNat will retain a minority interest along with representation on the board.

-

Elliott Management, the other key suitor for the business, is understood to have dropped out of the auction.

-

This is UPC’s latest attempt to downsize after offloading part of its personal lines business to HCI.

-

After securing a $1.6bn deal to acquire TigerRisk, Howden said the transaction will create a “much-needed fourth global player” in reinsurance.

-

This publication first revealed that the two parties were working on the deal last month.

-

Sources indicated talks have been conducted using an adjusted Ebitda figure for TigerRisk of around $85mn-$90mn, which is far higher than previously thought.

-

It is understood that the highest bidder was a consortium formed by Fortitude and Global Atlantic.

-

A takeover would boost Howden’s burgeoning reinsurance portfolio.

-

The deal propels HSCM total AuM and capital commitments to above $4bn.

-

Many hybrids, unless they are willing to take a meaningful financial hit to secure a divestiture, will have to stick with their reinsurance businesses through the current cycle.

-

The carrier also revealed $30mn in Russia-Ukraine Q1 losses.

-

Jefferies has been awarded the mandate to seek a buyer for the segment.

-

Acrisure entered into a definitive agreement with Markel in March to acquire the MGA.

-

The retro fund has redeemed 99% of share capital, returning around $106mn to public fund investors.

-

The deal will also provide $100mn in new equity funding to the legacy carrier.

-

The purchaser is known for having a very low cession ratio, although it said it would leave Alleghany to operate independently.

-

The acquirer has forecast premiums of $1bn by 2025 at the multi-class coverholder

-

The transaction will create a reinsurance entity roughly on a par with Scor in terms of net reinsurance premium.

-

The deal values the TransRe owner at 1.26 times book value as of 31 December 2021, and represents a 29% premium on its stock price.

-

Completion of the buyout remains subject to US bankruptcy courts recognising the agreement.

-

-

The new company will focus on expanding into US coastal areas.

-

-

The firm has been in run-off since late 2020, and another former Credit Suisse affiliate was recently sold to legacy writer Marco.

-

Nephila will maintain a minority holding in the MGA, which is looking for paper from more reinsurers and ILS firms.

-

The deal follows a similar transaction on northeast business in January.

-

The reincarnated $9bn deal is moving a step closer to completion.

-

The target firm deals in engineering, energy, P&C and specie.

-

The investor agreed to buy Ascot in 2016 and Wilton in 2014.

-

The deal was struck in the wake of the collapse of Aon and Willis Towers Watson’s merger.

-

As part of the deal, Heritage will transfer ownership of carrier Pawtucket and MGA First Access, as well as claims and underwriting data.

-

As a result of the deal, EY, through its wholly owned subsidiary Shackleton, becomes a minority shareholder in IncubEx.

-

The Bermudian fund bought £280,000 of shares in the Lloyd’s investment platform.

-

The watchdog had been due to announce a decision on a further inquiry by 29 November.

-

Fairfax has entered into an agreement with the Canada Pension Plan Investment Board (CPPIB) and the Ontario Municipal Employees Retirement System (Omers), where each of them will acquire a 4.995% stake in Odyssey Group for an aggregate cash consideration of $900mn.

-

Markel Catco announced that its proposed buyout of investors will be delayed until the first quarter, as a Bermuda court adjourned hearings on the scheme into early December.

-

However, the deal is low-to-mid ranking in terms of book multiple.

-

The two parties had previously negotiated a $9bn deal for the reinsurer last year, which was later scrapped.

-

The speciality insurer is also providing multi-year capacity and paper to the climate risk shop.

-

The transaction is to increase the run-off specialist’s balance sheet significantly.

-

The deal marks a return for Spencer Re founder and Taussig CEO Joseph Taussig.

-

After the acquisition, the Beech team will continue to be led by Geoff Stilwell, Andrew Woodhams and Matt Gates.

-

The Competition and Markets Authority will investigate whether the deal lessens competition in the UK.

-

The Credit Suisse-backed firm produced a small profit in the first quarter of 2021, the ratings agency said.

-

The managing general agency is looking for new lines of business, having seen its cyber team and capacity provider depart ahead of renewals earlier this year.

-

The broker has explained the rationale for its $3.25bn acquisition of Willis Re on an investor call.

-

After the collapse of the Aon-Willis merger, Gallagher has successfully resurrected the deal that will catapult its reinsurance operation into the big league.

-

American National CEO Jim Pozzi said the acquisition would be an “energizing moment” in the carrier’s history.

-

Moody’s expects RMS, which had about $320mn in revenue around $55mn in operating income last year, to become accretive to earnings by 2025.

-

Sources have said a deal could be signed as soon as the middle of the week, with a valuation higher than the last agreement.

-

The collapse of the Aon-Willis deal will have no noticeable impact on the ILS broking business, as the market waits to see what the fate of the Willis Re team will be.

-

The companies disclosed that Aon will pay Willis the $1bn break fee.

-

As part of expansion plans, Ki has also signed a stock purchase agreement to acquire an inactive insurance carrier that holds licenses in more than 40 states.

-

The potential transaction is expected to complete in the third quarter.

-

The brokers have offered to divest Willis’ largest corporate risk and broking clients to Gallagher’s Crombie Lockwood.

-

The competition watchdog has approved the acquisition of Willis Towers Watson by Aon if the latter complies with a ‘substantial set of commitments’, including the divestment of central parts of Willis’s business to Gallagher.

-

Aon will have to wait until November at the earliest to argue the case in Federal Court for its $30bn merger with Willis Towers Watson.

-

The Commerce Commission has extended its review of the merger by another six weeks.

-

The French mutual has been looking to expand, with recent unsuccessful attempts to acquire Scor and PartnerRe.

-

The broking houses also said they "remain fully committed to the benefits of [their] proposed combination".

-

The deal is designed to assuage the Department of Justice’s concerns over the Aon-Willis merger.

-

Century Equity Partners and WT Holdings are backing the new venture.

-

The US government reportedly has around 20 attorneys at work in case it decides to sue to block the deal.

-

The carrier cut back its treaty limit by around 13% and lowered its deductible.

-

The transaction will create London’s largest independent specialty and wholesale broking business.

-

The merging brokers have also agreed a two-year non-compete agreement on transferring Willis business.

-

There are few areas of overlap in the Willis Re-Gallagher Re combination but some details to be ironed out on the new executive team.

-

The AJG CEO vowed to invest in Willis Re assets while stressing the quality and security of the team.

-

The buyer says the deal involves revenue of about $1.3bn and earnings of around $357mn.

-

The merger partners are working towards a third-quarter completion after a side-deal they say addresses EC concerns.