-

Founder and CEO of Nascent Andre Perez will join Sephira’s board of directors.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

The business has been ~70% owned by White Mountains since January 2024.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

The leadership’s commentary spotlighted to value of ILS to the group.

-

It is understood that CyberCube has been considering a sale of the business.

-

The Japanese carrier faces integration challenges to make a success of the deal.

-

Aspen Capital Markets earned $169mn in fee income in 2024 alone.

-

The purchase brings Sompo an established ILS platform as part of the deal.

-

The Bermudian firm has an active ILS division, unlike the Japanese conglomerate’s insurance divisions.

-

The transaction is expected to close later this year.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

The deal leaves premier surety as Travelers' sole Canadian portfolio.

-

The reinsurer said the probe concerns the alleged involvement of its former chairman.

-

The acquisition expands its global employee benefits business to ~4,000 global employees.

-

Guernsey’s TISE listed the world’s first private cat bond issued by Solidum Re in 2011.

-

The firm will match segregated accounts of portfolios to investor mandates.

-

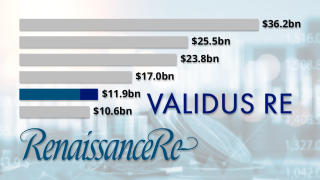

The combined entity ranks third in the Insurance Insider ILS leaderboard.

-

Compressed cat bond spreads could drive some rebalancing, as M&A remains a prospect.

-

The deal comes around three years after Markel sold a controlling interest in Velocity for $181.3mn.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The Swiss-based team of Siglo has transferred to Cambridge Associates.

-

Redington provides services to UK pension funds, wealth managers and institutional investors.

-

The Risk International team will remain in its current location, under Jennifer Gallagher.

-

The denial followed this publication’s report that Covéa had renewed its intentions to buy the reinsurer.

-

The mutual’s approach comes as Scor continues efforts to fight back from performance issues including a flare-up in L&H.

-

The transaction complements its previous acquisition of RMS in 2021.

-

The deal will boost the investment consultancy’s ILS capabilities.

-

Winning higher-fee private ILS mandates will strengthen firms’ negotiating positions.

-

The deal will include Axa IM’s alternatives funds including ILS.

-

The combined Twelve-Securis entity would be a top-five ILS firm currently.

-

Urs Ramseier will be CEO and Herbie Lloyd CIO.

-

The sale is expected to be completed by the end of the year.

-

Sources said that Japanese big-three carrier Sompo and Italian insurance giant Generali are circling.

-

Former Teneo M&A head Alexander Schnieders will lead the unit.

-

The management’s buyback acquisition brings an end to the two-year relationship.

-

GeoVera’s MGAs will sell to SageSure and insurance companies will merge with SafePort.

-

The Lloyd’s legacy business has been placed up for sale, along with other units.

-

The outlook for M&A activity is brighter after 2023 returns.

-

Arm is based in Guernsey and has a Bermudan management licence.

-

The newly launched Marco Re will be led by Mark Elliott as CEO.

-

A non-binding term sheet was signed on October 6, whereby the buyer will acquire 100% of Interboro’s issued and outstanding securities in exchange for cash.

-

BCCL will be rebranded to Nascent Advisory Services Ltd as part of the transaction.

-

-

The private equity firm is targeting $1trn in assets under management for the combined segment.

-

Frontier’s employees, including director and co-founder Peter Brodsky and CEO Derek Winch, will remain in their current roles.

-

The two parametric businesses will be brought together as the UK and German governments sell out.

-

The vehicle will focus on middle-market transactions in the US and Europe across the insurance value chain.

-

The firm has moved to defend its plans against a rival strategy supported by a small group of investors.

-

The carrier has agreed to acquire the former Credit Suisse ILS unit, following the acquisition of sister company Humboldt Re in 2021.

-

Financials Acquisitions Corp is looking to extend its merger deadline and raise “substantial” extra funds.

-

Removing any competitor is a positive for ILS peers in a competitive time for fundraising, but it is not clear how much of a boost this will give RenRe.

-

The takeover will push it up two places to rank as the fifth-largest writer of P&C reinsurance by gross premium.

-

AIG will invest a significant amount into Fontana and DaVinci.

-

The Bermudian reinsurer launched a public offering of 6,300,000 common shares and anticipates raising around $1.15bn to finance the transaction.

-

The deal includes AIG's AlphaCat platform.

-

The AJ Gallagher-owned ILS services provider is expanding its footprint globally.

-

The non-catastrophe ILS platform hit a valuation of $1bn after a Series C funding round.

-

The acquisition gives UK asset manager Liontrust a broader European footprint and cat bond products.

-

Bay Risk will become part of Gallagher Re’s Global Programmes practice group, led by Andrew Moss.

-

The reinsurer said in its Q4 earnings call that Argo’s takeover further diversifies its operations and adds a foundational piece to its expanding P&C activity in the US.

-

The international reinsurance unit booked almost EUR1bn in revenue in 2022.

-

-

Bowood managing director Stephen Greener will chair the entity, which is to place $6bn in GWP.

-

Vesttoo's aim for the partnership is to bridge the gap between the insurance and capital markets, scaling insurance-linked investments as a source for reinsurance capacity.

-

The acquisition will enable the Japanese carrier to expand further into the US and across a host of insurance lines, including property and marine.

-

There is no guarantee that the process will yield a particular transaction.

-

The former Chubb exec will remain on the board as an independent director, along with president and CEO Jacques Bonneau.

-

The French mutual’s CEO Thierry Derez and chief of staff Sylvestre Frezal said the deal is a strategic move to adapt to new forms of risk.

-

Kiln and UPC partnered to form the insurer in 2018, but it was merged into American Coastal earlier this year

-

FedNat will retain a minority interest along with representation on the board.

-

Elliott Management, the other key suitor for the business, is understood to have dropped out of the auction.

-

This is UPC’s latest attempt to downsize after offloading part of its personal lines business to HCI.

-

After securing a $1.6bn deal to acquire TigerRisk, Howden said the transaction will create a “much-needed fourth global player” in reinsurance.

-

This publication first revealed that the two parties were working on the deal last month.

-

Sources indicated talks have been conducted using an adjusted Ebitda figure for TigerRisk of around $85mn-$90mn, which is far higher than previously thought.

-

It is understood that the highest bidder was a consortium formed by Fortitude and Global Atlantic.

-

A takeover would boost Howden’s burgeoning reinsurance portfolio.

-

The deal propels HSCM total AuM and capital commitments to above $4bn.

-

Many hybrids, unless they are willing to take a meaningful financial hit to secure a divestiture, will have to stick with their reinsurance businesses through the current cycle.

-

The carrier also revealed $30mn in Russia-Ukraine Q1 losses.

-

Jefferies has been awarded the mandate to seek a buyer for the segment.

-

Acrisure entered into a definitive agreement with Markel in March to acquire the MGA.

-

The retro fund has redeemed 99% of share capital, returning around $106mn to public fund investors.

-

The deal will also provide $100mn in new equity funding to the legacy carrier.

-

The purchaser is known for having a very low cession ratio, although it said it would leave Alleghany to operate independently.

-

The acquirer has forecast premiums of $1bn by 2025 at the multi-class coverholder

-

The transaction will create a reinsurance entity roughly on a par with Scor in terms of net reinsurance premium.

-

The deal values the TransRe owner at 1.26 times book value as of 31 December 2021, and represents a 29% premium on its stock price.

-

Completion of the buyout remains subject to US bankruptcy courts recognising the agreement.

-

-

The new company will focus on expanding into US coastal areas.

-

-

The firm has been in run-off since late 2020, and another former Credit Suisse affiliate was recently sold to legacy writer Marco.

-

Nephila will maintain a minority holding in the MGA, which is looking for paper from more reinsurers and ILS firms.

-

The deal follows a similar transaction on northeast business in January.

-

The reincarnated $9bn deal is moving a step closer to completion.

-

The target firm deals in engineering, energy, P&C and specie.

-

The investor agreed to buy Ascot in 2016 and Wilton in 2014.

-

The deal was struck in the wake of the collapse of Aon and Willis Towers Watson’s merger.

-

As part of the deal, Heritage will transfer ownership of carrier Pawtucket and MGA First Access, as well as claims and underwriting data.

-

As a result of the deal, EY, through its wholly owned subsidiary Shackleton, becomes a minority shareholder in IncubEx.

-

The Bermudian fund bought £280,000 of shares in the Lloyd’s investment platform.

-

The watchdog had been due to announce a decision on a further inquiry by 29 November.

-

Fairfax has entered into an agreement with the Canada Pension Plan Investment Board (CPPIB) and the Ontario Municipal Employees Retirement System (Omers), where each of them will acquire a 4.995% stake in Odyssey Group for an aggregate cash consideration of $900mn.

-

Markel Catco announced that its proposed buyout of investors will be delayed until the first quarter, as a Bermuda court adjourned hearings on the scheme into early December.

-

However, the deal is low-to-mid ranking in terms of book multiple.

-

The two parties had previously negotiated a $9bn deal for the reinsurer last year, which was later scrapped.

-

The speciality insurer is also providing multi-year capacity and paper to the climate risk shop.

-

The transaction is to increase the run-off specialist’s balance sheet significantly.

-

The deal marks a return for Spencer Re founder and Taussig CEO Joseph Taussig.

-

After the acquisition, the Beech team will continue to be led by Geoff Stilwell, Andrew Woodhams and Matt Gates.

-

The Competition and Markets Authority will investigate whether the deal lessens competition in the UK.

-

The Credit Suisse-backed firm produced a small profit in the first quarter of 2021, the ratings agency said.

-

The managing general agency is looking for new lines of business, having seen its cyber team and capacity provider depart ahead of renewals earlier this year.

-

The broker has explained the rationale for its $3.25bn acquisition of Willis Re on an investor call.

-

After the collapse of the Aon-Willis merger, Gallagher has successfully resurrected the deal that will catapult its reinsurance operation into the big league.

-

American National CEO Jim Pozzi said the acquisition would be an “energizing moment” in the carrier’s history.

-

Moody’s expects RMS, which had about $320mn in revenue around $55mn in operating income last year, to become accretive to earnings by 2025.

-

Sources have said a deal could be signed as soon as the middle of the week, with a valuation higher than the last agreement.

-

The collapse of the Aon-Willis deal will have no noticeable impact on the ILS broking business, as the market waits to see what the fate of the Willis Re team will be.

-

The companies disclosed that Aon will pay Willis the $1bn break fee.

-

As part of expansion plans, Ki has also signed a stock purchase agreement to acquire an inactive insurance carrier that holds licenses in more than 40 states.

-

The potential transaction is expected to complete in the third quarter.

-

The brokers have offered to divest Willis’ largest corporate risk and broking clients to Gallagher’s Crombie Lockwood.

-

The competition watchdog has approved the acquisition of Willis Towers Watson by Aon if the latter complies with a ‘substantial set of commitments’, including the divestment of central parts of Willis’s business to Gallagher.

-

Aon will have to wait until November at the earliest to argue the case in Federal Court for its $30bn merger with Willis Towers Watson.

-

The Commerce Commission has extended its review of the merger by another six weeks.

-

The French mutual has been looking to expand, with recent unsuccessful attempts to acquire Scor and PartnerRe.

-

The broking houses also said they "remain fully committed to the benefits of [their] proposed combination".

-

The deal is designed to assuage the Department of Justice’s concerns over the Aon-Willis merger.

-

Century Equity Partners and WT Holdings are backing the new venture.

-

The US government reportedly has around 20 attorneys at work in case it decides to sue to block the deal.

-

The carrier cut back its treaty limit by around 13% and lowered its deductible.

-

The transaction will create London’s largest independent specialty and wholesale broking business.

-

The merging brokers have also agreed a two-year non-compete agreement on transferring Willis business.

-

There are few areas of overlap in the Willis Re-Gallagher Re combination but some details to be ironed out on the new executive team.

-

The AJG CEO vowed to invest in Willis Re assets while stressing the quality and security of the team.

-

The buyer says the deal involves revenue of about $1.3bn and earnings of around $357mn.

-

The merger partners are working towards a third-quarter completion after a side-deal they say addresses EC concerns.

-

CEO Talbir Bains founded the business in 2017 with backing from the market’s largest ILS manager.

-

The cat bond will renew an expired 2017 multi-peril deal for the US insurer.

-

The regulator had previously set a 27 July deadline after the merger partners offered divestments to secure regulatory approval.

-

Chairman Paul Folino said he expected the deal to be completed over the second quarter.

-

European regulators are not expected to demand additional concessions of the deal partners.

-

Credit Agricole served as the debt arranger, with Sompo Japan and Aioi Nissay Dowa Insurance acting as insurers.

-

The move follows Willis’ explorations of sales of Willis Re and European units.

-

Fallout from the 2019 JLT Re integration intensifies after a group including Brad Maltese were earlier reported to be set to join Howden.

-

It is understood that the ~$300mn fac business will be packaged along with the treaty unit.

-

The market has reached the stage of price hardening at which clients will challenge brokers and carriers on continuing increases, according to Aon president Eric Andersen.

-

The erstwhile suitor cites falling valuations for residential property technology companies.

-

The $7.5bn bid requires more certainty of value and a higher cash consideration, according to CoreLogic's CEO.

-

EU antitrust regulators will warn Aon that its $30bn bid to acquire Willis Towers Watson may hurt competition in the broking marketplace, according to a Reuters report.

-

The merger may cause price increases or reduced service levels for major insurance buyers.

-

The two PE firms each take a 30% stake in the business, alongside Arch management.

-

Executives reiterate the mid-single expansion guidance announced in March, despite growing organically by 1% in 2020.

-

The modeller had reportedly been the subject of an $86-per-share bid from real estate analytics firm CoStar prior to its $80 deal.

-

Gebauer, Kent, Pullum and Garrard are among the Willis execs named to big jobs.

-

Co-founders Joe King, Enda McDonnell and Adrian Ryan remain in their posts and retain minority stakes in the business.

-

The vehicle raised $240mn in an offering priced at $10 a share.

-

The deal is the latest in a slew of recent blank check listings this year.

-

The deal “may reduce choice” for cedants in choosing reinsurance brokers, the EC said.

-

The 12 Days of ILS Christmas

-

HCI is offering $5.2mn in stock plus up to $3.1mn cash for the portfolio.

-

The broker will operate as Acrisure Re and Acrisure London Wholesale.

-

The unit will advise on M&A, capital raising and risk securitisation.

-

The deal will help the Aquiline-owned syndicate diversify away from motor insurance.

-

This is the fourth acquisition by Ardonagh's Geo this year, following transactions involving Rural, Thames Underwriting and KGM Underwriting.

-

The Day 1 launch via a listing without PE cornerstone investors is an effective first for the (re)insurance sector.

-

The deal will accelerate the pivot of the acquirer from motor insurer to multi-class specialty player.

-

ILS manager Hudson Structured is among the prior owners selling Compre, after buying into the legacy firm in January.

-

As part of the deal Pelican Ventures and JC Flowers will provide capital for 2021 onwards, with Argo maintaining responsibility for years prior.

-

The tactic comes after the investors had three nominees installed on the risk modeller’s board this week.

-

The subsidiary was formed in the summer and is deploying capital from the sale of Maison.

-

The three director changes fall short of a proposal by former bidders Senator and Cannae.

-

It is expected that the transaction will close in the first quarter of 2021 and that Vault will retain its A- rating from AM Best.

-

The exec was speaking after the broker was acquired by Cinven and GIC in a multi-hundred million deal.

-

The transaction brings to an end five years of Willis’ majority ownership of the London market broking house.

-

The deal continues HSCM's progression into primary markets.

-

Ariel Re will focus on key lines of business, including cat, retro, marine and professional lines.

-

Southern Fidelity has struggled during a busy 2020 storm season because of its exposure to the Gulf states.

-

Former CEO Ryan Mather returns to helm Ariel, and will also oversee underwriting for SPA 6133 under a pact between the acquirers and Apollo.

-

Including offshore losses of up to $1.5bn, the firm's total loss estimate ranges from $0.8bn-$1.5bn.

-

The $622mn agreement is just 10 cents a share higher than Enstar's $31.00-per-share proposal.

-

Former RenaissanceRe CEO and founder Jim Stanard looks set to pick up the reinsurance platform.

-

The per-share price is a 35% premium to yesterday’s close.

-

The Howden parent has more than doubled its valuation in the three years since CDPQ invested.

-

BMS plans to expand into the retro sector but will avoid being drawn into bidding "frenzy".

-

The funding for the deal was set to come from Cantor Fitzgerald and its billionaire CEO Howard Lutnick.

-

Both companies secure more than 95% shareholder support for the transaction.

-

The companies claim “overwhelming” investor support at meetings today.

-

The agreement, which will leave Enstar with 26% of StarStone US, fulfills a long-term ambition for Stone Point.

-

The business will be known as SiriusPoint and led by ex-AIG CFO Sid Sankaran, who will become chairman and CEO.

-

KKR described the $4.4bn deal as a “transformative event” and a “highly strategic” investment for the company.

-

The deal will generate proceeds of more than $1.5bn for the Karfunkel family and including a dividend is pitched at 69 percent more than Tuesday's close.

-

The deal will give Buckle access to Gateway’s 47 US state insurance licences.

-

The deal will see HSCM founder Millette and HSCM Bermuda clients assume majority control of the holding company.

-

SkyKnight, Dragoneer and Aquiline have led the investment.

-

The fronting carrier will allow the MGA to extend its geographical reach.

-

The statements come after an outline agreement, signed by Covea 10 weeks ago, collapsed this week.

-

The Bermudian’s owner Exor refused to renegotiate terms due to the Covid-19 crisis.

-

The company’s remaining underwriting teams will transfer to San Diego-based MGA platform K2.

-

The deal will “capitalise on a dynamic competitive landscape and continue our strong growth trajectory”, Rod Fox says.

-

-

The M&A deals were predominantly mergers, but there was some activity on the acquisition side as well.

-

French insurer is reportedly confident despite stock prices having plummeted since the takeover was agreed.

-

The start-up received a financial strength rating of A- from AM Best as it announced its new funding.

-

The pandemic financial crisis led to the M&A deal being dropped.

-

Lighthouse CEO Patrick White bought a majority stake in Prepared in 2017.

-

Canadian pension funds have shown an interest in buying assets in the London market.

-

But the merger will still create opportunities for rival brokers to claim market share.

-

Having a $20bn-revenue organisation would create the ability to invest more heavily in new solutions, including tech.

-

The combined company will retain the Aon name, with Willis CEO John Haley taking the chairman role.

-

The insurer will offer to buy out side-pocketed assets at a discount, with several hundred millions of capacity available if needed.

-

Exor would receive cash consideration of $9bn plus a cash dividend of $50mn to be paid before closing.

-

Further growth of the carrier will be constrained if it can’t bolster its balance sheet.

-

The broker said it was considering next steps for the wholesale arm to maximise its growth.

-

-

The January 2020 sidecar renewal season could emerge as a turning point in the evolution of reinsurer ILS tactics and strategies.

-

Some reductions in demand might follow as policies change hands, but this will not be a key influence on renewal dynamics.

-

The rating agency highlighted the increased underwriting risk associated with Weston's pending acquisition of Texas and Louisiana writer Anchor Specialty.

-

Florida-based Centauri Specialty is to sell its Louisiana homeowners' insurer offshoot.

-

The MGA start-up offers $25mn lines in property per risk.

-

Hiscox sold the parametric cyber cover to an as-yet-undisclosed buyer.

-

The pension fund will acquire the stake from Fairfax for a cash sum of $560mn.

-

The firms, which provide banking and ILS services, have joined to create the sixth largest US commercial bank.

-

The deal is set to close in the first half of 2020 and will see the Singaporean reinsurer enter run-off.

-

As part of the deal, 1347 PIH received five-year rights of first refusal to provide reinsurance on up to 7.5 percent of FedNat’s catastrophe reinsurance programme.

-

The Grahame Chilton-founded firm will become Gallagher's reinsurance partner if a deal is finalised.

-

Private equity firm The Carlyle Group has lifted its stake in Fortitude above 70 percent.

-

EWI provides services for captives and mutual insurance companies as well as run-off and legacy solutions.

-

Currently, most people trying to describe the ILS manager world might break the peer group into three broad categories: reinsurer-affiliated platforms, independent owner-operated firms and asset manager-backed vehicles.

-

The insurer is buying a new £500mn cover to sit beneath its SuperCat and MegaCat treaty cover for 1 January.

-

New owner AJ Gallagher will be able to support tech and other investments in the ILS platform.

-

The deal follows up a EUR10mn ($11.7mn) private subordinated debt placement in July 2017.

-

The transaction makes Canopius a top-five insurer in the Lloyd’s marketplace.

-

Horseshoe CEO Andre Perez and other employees will continue to operate from their present locations, reporting to Artex CEO Peter Mullen.

-

The acquisition will not impact the ILS fund manager, managing partner and president Richard Pennay has said.

-

The Japanese carrier will acquire the White Plains, New York-based high-net-worth specialist via Tokio Marine HCC.

-

Assured Guaranty paid $160mn in cash for the alternative asset management firm which has $18.9bn in assets under management.

-

Bold Penguin has raised $32mn from a series B funding round.

-

Michael Halsband was formerly a partner at Drinker Biddle & Reath.

-

José Manuel González will lead the combined business as CEO.

-

The deal announced in May takes the reinsurer’s ILS assets to $2.1bn.

-

M&A activity has made analysing structural conflicts in ILS platforms harder but winners may be those that offer a range of means of access to risk, consultants say.

-

Do we need new labels for the different types of ILS managers that exist?

-

The MGU will be integrated into the Arch platform, enabling third-party capital to provide capacity alongside Arch’s product offerings.

-

Just two percent of the insurer’s portfolio has exposure to US risk.

-

The insurer said it was looking forward to expanding Barbican’s relationships with third-party capital.

-

BlueOrchard manages the InsuResilience Investment Fund which provides access to insurance in the developing world.

-

The firm was previously reported as being in the process of tapping the ILS market for capital to support its underwriting portfolio.

-

The institutional asset manager ownership model could help the ILS asset class shed its niche feel, Secquaero founder Dirk Lohmann suggested to Trading Risk.

-

The service provider will be merged with Inflexion private equity’s existing portfolio manager Ocorian.

-

The ILS manager will be integrated into the Schroders Private Assets unit and renamed Schroder Secquaero.

-

There will be no change to the running of the ILS fund Merion Square or its strategy, managing partner Richard Pennay told Trading Risk.

-

Fosun said Tenax Capital will become one of its most important European asset management platforms.

-

Ultimately, with advantages and challenges in any ownership situation, the parentage of an ILS platform is not going to be the determining factor in its success.

-

Elementum is a “well-positioned business in an attractive sector,” the asset manager said in a Securities and Exchange Commission filing.

-

The industry’s market heavyweights remain split amongst different types of ownership models.

-

This comes as Lockton has also been on a recruitment drive to boost its reinsurance division.

-

An existing longevity swap held by the Rolls-Royce UK Pension Fund was restructured as part of the transaction.

-

The deal valued BMS at £500mn and is expected to close in the third quarter.

-

The minority sale will leave the firm operating independently, the firm’s co-founders told Trading Risk.

-

The firm will invest $50mn in Elementum’s ILS funds.

-

The combination would have around $2.1bn of assets under management.

-

M&A deals have resulted in reinsurer affiliated businesses overtaking the market share of independent ILS firms, but asset managers have also grown their share via new launches since 2014.

-

Coriolis execs Diego Wauters and Martin Jones will stay for at least two years to continue to run the business.

-

Scor chairman and CEO Denis Kessler said the acquisition would help its ILS platform move into the top tier of the market.

-

Cohen & Company’s head of US insurance strategies sees ILS opportunities from the new venture and wider business.

-

FedNat agreed to acquire 1347 PIH’s homeowners’ insurance operations.

-

The Bermuda-based ILS manager has signed up to use the specialist’s climate risk tools.

-

The takeover was announced in October last year and all parties now anticipate closing the transaction “as soon as possible”.

-

Irish regulations required an early announcement from the firm that it had considered a deal.

-

A deal would take the combined entity to the top spot by (re)insurance broking business revenue.

-

-

The ‘blank cheque’ company, led by John Butler, will look to acquire a company within the (re)insurance and InsurTech space.

-

The private equity firm has brought in Mark Cloutier as CEO.

-

The deal could boost its Lloyd’s capacity by 50 percent.

-

The insurer plans to shed 7.5 percent of its global workforce.

-

Mitsui Sumitomo Insurance (MSI) now owns 80 percent of Leadenhall Capital Partners after taking over the holding from its international subsidiary MS Amlin.

-

A large reinsurer is looking at launching an ILS fronting business to fill the gap left by the pending departure from the space of Tokio Millennium Re.

-

The Luca Albertini-led ILS manager will become a direct subsidiary of the Japanese insurance group, rather than being held by MS Amlin.

-

Many Bermuda staff have only been offered short-term transition roles.

-

Matthias Meyenhofer had taken up his role last September.

-

He moves across from the broker’s former securities division.

-

There was also evidence of one investment manager renewing its interest in the asset class.

-

The fund manager’s scarce capacity contributed to a generally difficult retro renewal at 1 January for buyers

-

ILS broker-dealers expect 2019 cat bond issuance to range from $7bn to above $10bn.

-

Nephila Climate has done a couple of recent swaps covering wind farms.

-

The Dodeka XX notes were listed on the Bermuda Stock Exchange yesterday.

-

Orchid CEO Brad Emmons will continue in his role after the sale.

-

The Latin American investment bank has backed the ILS start-up to launch a new low volatility fund in 2019.

-

The retro manager also warned 2018 wildfire losses could exceed those of last year.

-

This comes after the (re)insurer shifted away from offering market-facing ILS vehicles.

-

Nephila's sale to Markel has completed, giving the (re)insurance holding company a 20 percent share of the overall ILS market.

-

Two M&A deals in the ILS sector in the past month provide a contrasting view on what kind of acquirers may step forward in the future.

-

Insurers and reinsurers of the future will have more of a focus on packaging and ceding out risk, but there may be cultural challenges to reaching that goal, according to speakers at the Trading Risk New York Rendez-Vous.

-

Neuberger Berman has a diverse base of investors in areas Cartesian Re's ILS platform has not drawn from.

-

Fairfax has taken its total share of Brit to 88 percent with the purchase from the Canadian pension fund.

-

The $1bn ILW specialist will be remained NB Insurance-Linked Strategies after the sale.

-

The reinsurer said the fronting operations were “a very different business” than its own ventures division.

-

The deal also brings RenRe one of the largest fronting providers.

-

The $1.5bn deal also entails a reinsurance co-operation agreement between buyer and seller.

-

The insurer revealed the sum in its Q3 results.

-

BGC Partners has agreed to buy Lloyd's broker Ed Broking from private equity house Lightyear Capital, adding to its previous acquisition of London market intermediary Besso.

-

The asset manager and Oppenheimer’s former owner MassMutual have entered into an agreement which will bring Invesco’s total assets under management to $1.2 trillion.

-

Terms of the deal were not disclosed.

-

Reinsurance buyer preferences may influence the direction of M&A, suggested panellists at the Baden-Baden Guy Carpenter symposium.

-

Primary insurer consolidation poses more risk to the reinsurance sector than the merging of insurers and reinsurers, Scor’s Adrian Jones said.

-

The sale, expected to be completed in the fourth quarter of 2018, will generate net proceeds of $130mn, Man Group said.

-

The buyer expects to pay about £102mn ($134.7mn) in cash for Beaufort Underwriting Agency and its Syndicate 318.

-

Apollo committed an additional $700mn of equity capital to Catalina on completion of the buy-in deal.

-

M&A is once again at the forefront of industry minds, as Scor and RenaissanceRe have been fending off bidders and activist investors in recent weeks.

-

The new platform connects holders of long-tail insurance risks with investment funds.

-

But the reinsurer will likely retain its independence, experts say.

-

JLT CEO Dominic Burke said acquirer MMC valued the entrepreneurial culture at the firm.

-

-

Moving a step away from short-tail risks could be on the agenda after the insurer's takeover of the ILS giant.

-

A change of ownership is envisaged comfortably before year-end, it is understood.

-

The French carrier has received final regulatory approval for its $15.3bn acquisition of XL Group.

-

Duperreault recognises the quality of the Bermudian reinsurance industry.

-

Recent M&A deals point to the prospect of the ILS market disintermediating the reinsurance channel in future, said KBW analyst Christopher Campbell.

-

Aon Securities CEO Paul Schultz said he expects more transactions like the Markel-Nephila deal in the year to come.

-

Human behaviour now has a smaller role in determining pricing, according to the broker's president and global head of casualty.

-

Covea put in an all-cash offer of EUR43 ($49.85) per share for the French reinsurer, however the offer was turned down.

-

If you rewind to Monte Carlo a decade ago, Nephila and other ILS managers were merely an exotic corner of the reinsurance markets – independent, small teams slugging away at building up franchises. Ten years on and the industry’s largest manager has just sold up to Markel in a landmark M&A deal, and the ILS top 10 have boomed from under $10bn to $68bn in size.

-

Chaucer may be the first of a number of Lloyd’s and London market insurers that are up for sale to change hands, sister publication The Insurance Insider has reported.

-

Nephila’s sale to Markel is likely to accelerate the ILS manager’s push into primary insurance by bringing it closer to one of its key fronting partners as well as a carrier with distribution reach to the ultimate insurance buyers.

-

Co-founder says the ILS manager's relationship with fronting carrier Allianz will continue.

-

It affirmed the carrier’s A financial strength rating.

-

-

Sirius International Insurance Group and Easterly Acquisition Group have named Gallatin Point Capital as one of the investors on a private placement that will raise at least $213mn.

-

Aspen CEO Chris O’Kane said the acquisition by Apollo would help the group have additional scale and “take Aspen to the next level”.

-

Beat Capital Partners is merging with Paraline UK, owner of the Icat Lloyd’s syndicate 4242.

-

The deal would boost the Hartford’s ranking in the US commercial insurance market.

-

The (re)insurer said it had already bought an aggregate reinsurance cover for the combined Axa-XL entity and has decreased its cat exposure by about 40 percent relative to 2017.

-

M&A activity in the ILS manager market is continuing despite last year’s catastrophe activity, with one start-up being acquired by its cornerstone investor and the industry’s largest firm seeking new partners.

-

The reinsurer said a listing on the stock market will facilitate its growth.

-

The executive previously worked for Deutsche Bank's asset management division but left when the bank closed down its $100mn ILS fund last year.

-

The acquisition is expected to close in the second half of the year.

-

Swiss Re said it had ended talks with the Japanese technology investor Softbank about a possible minority stake deal.

-

A number of senior staff will leave XL Catlin ahead of its $15.3bn takeover by Axa.

-

Discussions between the reinsurer and technology investor SoftBank are at a standstill, Bloomberg News reported yesterday.

-

Florida carrier HCI has revealed details of an unsuccessful takeover bid it made for Federated National (FedNat) which resulted in a stock offer of at least $229mn.

-

HCI Group made an unsuccessful M&A approach to Federated National earlier this year.

-

Increased (re)insurance M&A activity may spark an increase in reinsurance buying and bring more risk to ILS markets, according to Aon Securities CEO Paul Schultz.