-

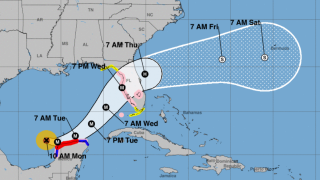

Milton is expected to move north of the Yucatan Peninsula today and cross the eastern Gulf of Mexico by Wednesday.

-

Parts of the Yucatan peninsula are under a hurricane warning, though the storm is expected to remain offshore.

-

The NFIP’s losses are estimated at $4.5bn-$6.5bn.

-

The class of 2023-24 cat bond funds will grow existing investors and add new ones.

-

Experts have raised concerns over significant rainfall, record-setting storm surge and lingering Hurricane Helene debris.

-

The “exceptionally large and powerful” Category 4 storm made landfall in Florida last month.

-

The Canadian pension plan put its Lloyd’s portfolio under review earlier this year.

-

The raise includes minority investments from Nationwide, Enstar and others.

-

The executive has worked for Hamilton for over a decade.

-

Richard Pennay will become CEO of Aon Securities.

-

The Risk International team will remain in its current location, under Jennifer Gallagher.

-

Rising sea levels and ocean warming were likely factors in Helene’s strength.