-

The reinsurer narrowed the scope of perils in its latest issuance versus its 3264 2022 cat bond.

-

Reinsurers “weren’t getting paid” before 2023’s hardening, the Lloyd’s executive argued.

-

-

Reinsurers scaled back their coverage to non-peak events in 2023.

-

He will continue to play a role as a fund director and firm ambassador.

-

The research body initially warned of an active storm season in April.

-

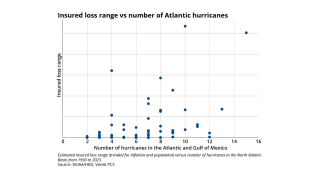

Reinsurers are much better placed to absorb cat losses; insurers are carrying more risk.

-

The Florida portion of the program provides $1bn in protection.

-

The global services provider has grown through acquisitions in recent years.

-

Former Teneo M&A head Alexander Schnieders will lead the unit.

-

The shift in market dynamics reflects $1.8bn of maturities last week.

-

Sub-1% management fee and performance fee-only structures have evolved in ILS.