Validus

-

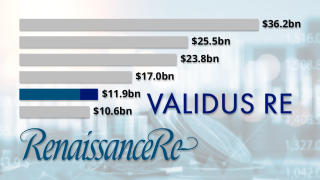

The takeover will push it up two places to rank as the fifth-largest writer of P&C reinsurance by gross premium.

-

The Bermudian reinsurer launched a public offering of 6,300,000 common shares and anticipates raising around $1.15bn to finance the transaction.

-

This came as parent AIG said it had around $6bn of reinsurance limit available for 2023.

-

Based in Bermuda, Jesse DeCouto will report directly to Validus Re CEO Chris Schaper.

-

All four layers are priced at the lower end of the original guidance, as the deal grew from a target size of $275mn.

-

The bond in four tranches will cover named storm and earthquake risk.

-

Brooks had been in his post for almost two years and joined AlphaCat in 2011.

-

Sven Wehmeyer, who will remain as CEO of Validus’s Zurich-domiciled reinsurance arm, replaced Steve Bardill as head of international on 1 June.

-

Regional per occurrence deals were also down compared to last year, but Validus lifted its retro cover by $75mn.

-

The carrier will take a smaller line than initial backers PartnerRe and Swiss Re.

-

The move follows the departures of Validus Re CEO Jeff Clements and head of US property underwriting Chris Silvester.

-

AIG's reinsurance subsidiary has just $155mn of losses to retain before triggering retro recoveries.