-

Reinsurers continued to diversify into primary and specialty business.

-

The unit will support Ascot’s third-party capital business.

-

The insurer currently has $300mn of reinsurance limit from cyber cat bonds.

-

Positive cat experience impact of $600mn was offset by $500mn in property and specialty reserves.

-

The P&C Re CoR came in at 84.5%, a 10.2-point YoY improvement.

-

The CEA has $326.4mn towards risk transfer, 44% below budget.

-

The timing is “opportune” to start the strategy according to Bennelong.

-

Leadenhall first filed its lawsuit against 777 Partners in May this year.

-

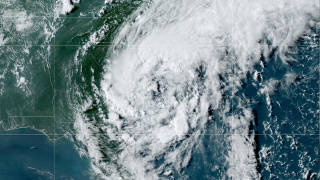

Total catastrophe losses stemmed from 20 events and were estimated at $587mn.

-

-

Sources said Guy Carpenter has promoted Jennifer Paretchan to succeed Mowery.

-

The ILS business increased H1 fee income by 13% to $68mn.