-

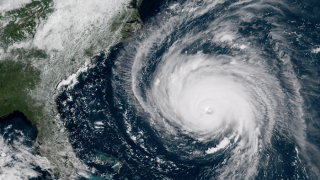

The Category 4 hurricane is strong enough to trigger the $110mn class C layer of Mexico's 2017 Multicat.

-

Insurance solutions that could encourage investment in disaster mitigation could help developing economies.

-

First Protective’s $350mn Frontline Re issuance is the main cat bond that is under watch as a result of Hurricane Michael, sources told Trading Risk.

-

Finance secretary Carlos Dominguez discussed the bond at the World Bank and International Monetary Fund (IMF) meeting in Bali last week.

-

Insured losses from Hurricane Michael have been estimated to fall within a wide $3bn to $10bn range.

-

Speaking at the Trading Risk Rendez-Vous in New York, Hudson Structured Capital Management’s Michael Millette said modelling misses helped the reload last year.

-

New domiciles introducing ILS regulations could help introduce more sponsors to the market, said Aon Securities CEO Paul Schultz.

-

Appetite for last-minute cover appears muted ahead of Hurricane Michael’s landfall in Florida.

-

The two firms both have large offices on the island, which could create overlap.

-

The $125mn cat bond remained unchanged in size, as pricing settled at the midpoint of the initial range.

-

The Loma Re Series 2013-1 Class C, Seaside Re 2017-3 and a portion of the $140.0mn Fibonacci Re 2017-1 have been extended, the BSX said.

-

Capital inflows continue to exceed loss outflows, the firm said.