-

The influx of capital, combined with a quiet wind season, led to favorable conditions for cedants during 1.1 renewals.

-

Cedants pursued property renewals “aggressively” amid excess reinsurer capacity.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

The storm outbreak follows similar events in the area in 2020 and 2023.

-

The outlook flags “large uncertainties” amid possible El Niño through summer 2026.

-

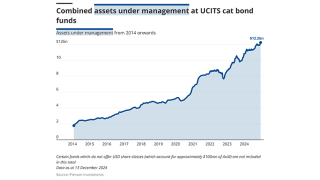

The firm’s external AuM has grown by 175% from 2019 to $3.3bn in 2025.

-

Secondary market pricing implies the sponsor could recoup a total of $50mn on the 2022-1 A note.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

The peril has been historically difficult to model compared to others.

-

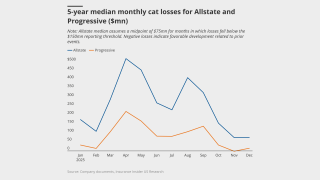

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

The (re)insurer has a higher-than-average Jamaican market share.

-

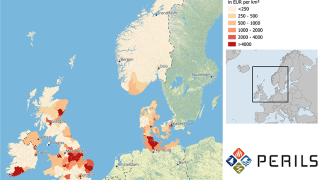

The largest net individual loss was January’s California wildfires at EUR615mn.

-

Insurance penetration varies, but hotels have “near-total” coverage and strong limits.

-

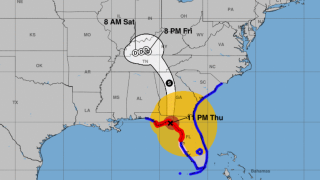

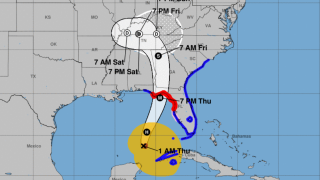

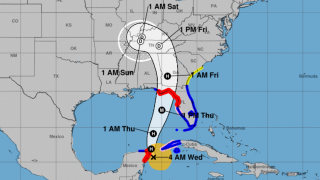

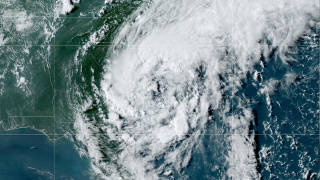

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

Widespread underinsurance and low exposures will limit losses.

-

Since 2007, the Caribbean country has received $100.9mn in payments from the CCRIF.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

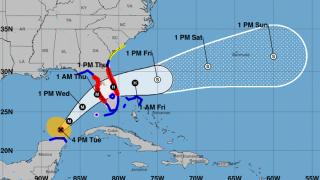

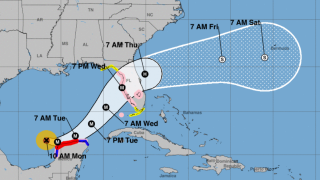

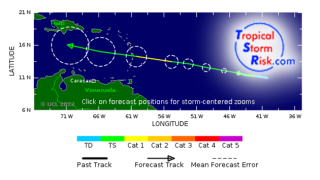

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

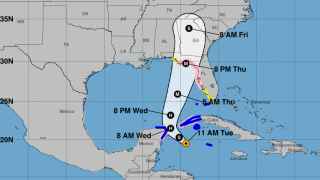

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

Central pressure of 900mb or below would trigger a full loss of the $150mn deal.

-

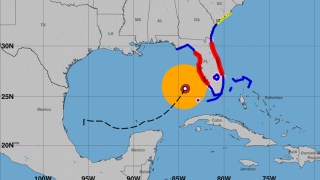

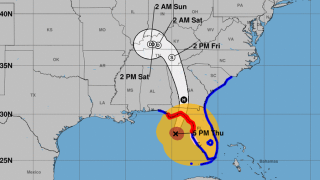

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

Pricing on Friday implied a potential $45mn loss to the bond, before the storm outlook deteriorated.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The tropical cyclone is expected to be named Imelda.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The major storm is set to move on to mainland China later in the week.

-

The economic loss from the event was around EUR7.6bn.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

Losses were primarily driven by personal property lines.

-

The sponsor extended two notes issued in 2022.

-

The volume of property cat aggregates placed grew 50% in 2025.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

The firm has also updated the loss-calculation engines of existing Jeannie tools.

-

The group claims the White House is undermining disaster preparedness.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

The estimate covers property and vehicle claims.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

ILS investors have fought shy of multi-peril aggs due to low confidence in SCS modelling.

-

Both organisations still predict an above-average hurricane season.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

The forecast has increased since the early July update due to several additional factors.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

The firm attributed a 9% drop in reinsurance NWP partly to higher cession rates.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

The figure updates an April estimate of EUR696mn.

-

The firm reported a net pre-tax cat loss of $414mn from January’s LA wildfires.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

The suit claims billions of dollars are being illegally withheld.

-

The US accounted for 92% of all global insured losses for the period.

-

US events accounted for more than 90% of global insured losses.

-

State legislation has led to major strides in rate adequacy.

-

We discuss progress in collateral management with our Outstanding Contributor winner.

-

Category 4 and 5 storms could become more common and hit further north.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The weather-modelling agency is predicting a below-normal season.

-

This comes in at the lower end of the initial spread guidance of 725-775 bps.

-

The investment consultancy said yields increased in Q2 by less than could have been expected.

-

Ex-Tropical Cyclone Alfred has been the costliest event, with A$1.36bn in losses.

-

The company said the reduction was due to years of steady improvements.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

PCS's loss estimate for the March Missouri SCS pushed the bond beyond its exhaustion point.

-

The Californian insurer had a private deal, Randolph Re, that provided pure wildfire protection.

-

In April, the loss modeller pegged losses at A$2.57bn.

-

The loss has decreased by 0.3% since the company’s third assessment.

-

The number has expanded by around 40% from an earlier update, sources said.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

The executive has 15 years of experience in meteorology and cat analytics.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

The $2.59bn renewal is up 45% from last year.

-

Up to nine million acres of US land are considered likely to burn.

-

Last week, TSR updated its forecast and is now predicting above-average storm activity.

-

Most of the losses are attributable to a supercell storm in Texas.

-

The company also has $100mn for US hurricane events.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

The deals covered Euro wind and Italy quake, Florida hurricane and a retro bond.

-

Almost 50,000 people have been forced to evacuate.

-

TSR previously predicted activity slightly below the 1995-2024 average.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

Tornadoes have killed at least 32 people in three states.

-

The targeted uplift comes after Mercury ceded nearly $1.3bn of wildfire losses to reinsurers in Q1.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Wildfire losses from fronting and ILS activities were EUR438mn.

-

Tropical Cyclone Alfred and Queensland flooding brought thousands of claims.

-

Ark's combined ratio included 25 points of catastrophe losses in Q1.

-

CEO Thierry Léger expects overall P&C pricing to be “stable” through 2025.

-

The insurer has not decided whether to sell its Eaton subrogation rights.

-

The CEO said private ILS funds can generate additional returns of 10%-20%.

-

Richard Pennay also addressed the dip in cyber ILS activity.

-

Private ILS would benefit from extension spreads to manage investor concerns, the CEO argued.

-

All 29 funds tracked by the index returned a positive performance.

-

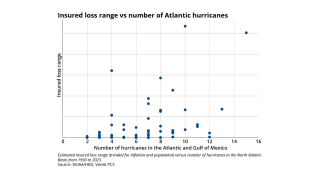

Growing economic and population exposures are driving potentially larger insured losses.

-

Six weeks after the storm, Perils released its first industry-loss estimate at EUR619mn.

-

January’s California wildfires meant third-party investors suffered a loss of $195.3mn.

-

The storm made landfall in Queensland, Australia at the beginning of March.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

The carrier surpassed the retention on its annual aggregate reinsurance cover for the year to March 31.

-

Insured losses were the second highest on record for the first quarter.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

KCC is part of the CDI’s review into creating a public wildfire cat model for insurers.

-

The sponsor is estimating a loss of ~$300mn in relation to one of last month’s US tornado events.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The prediction comes after a highly active hurricane season in 2024.

-

Colorado State University is predicting 17 named storms, nine hurricanes and four major hurricanes.

-

Losses stemmed from ex-Tropical Cyclone Alfred and North Queensland flooding.

-

The carrier has received 12,300 claims as of 28 March.

-

The event has caused widespread damage in Bangkok, Thailand.

-

Cat losses last month were lighter than historical trends, but all eyes are on Q1 figures.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

MAP’s Christopher Smelt said impact on nationwide programmes will cause risk aversion.

-

Both syndicates also reported a deterioration in their combined ratios.

-

Most of the industry losses occurred in Austria, the Czech Republic and Poland.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

The cat bond manager warned of excess downside risk owing to an accumulation of losses.

-

The insurance industry has experienced mounting losses from severe convective storms.

-

Premiums ceded to the ILS vehicle increased by 76% to $433mn.

-

Commissioner Lara also proposed a $500mn cash infusion from parent State Farm.

-

Island appetite remains stable, but early 2025 loss activity has injected fresh uncertainty.

-

The largest individual net loss at EUR230mn was caused by Hurricane Milton.

-

The bond was trading at around 12.3c on the dollar in the secondary market last month.

-

“We do not have the luxury of time,” he said during the Bermuda Risk Summit.

-

Both carriers have extensive reinsurance coverage.

-

This came as the market’s underwriting profit dipped 10% for 2024.

-

Almost 300,000 people have been left without power from the storm.

-

This loss number covers the property line of business.

-

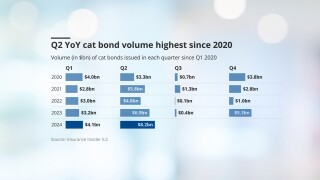

There is the potential for cat bond H1 issuance to be a record breaking six months.

-

As of 14 February, the company received 405 claims.

-

The London D&F market will shoulder most of the losses.

-

The reinsurer pegged the market loss at $40bn.

-

The carrier pegged its LA wildfire losses at EUR140mn.

-

Dispersion of returns was high, with the range 0.87% to -3.71%.

-

The programme structure was expanded, but it is unclear what percentage was placed.

-

The cost of reinstatement was included in $170mn wildfire net loss figure.

-

Climate change and other loss impacts were not adequately incorporated, sources said.

-

The CEO expects to see a larger shift between condos and apartments in 2026 and 2027.

-

HCI will now consist of two operating units – the other being its four underwriting entities.

-

ILS is delivering “a growing contribution” to the group, according to CEO Cloutier.

-

State Farm General has asked California regulators for an emergency rate increase.

-

There was a slight increase in DaVinci and Fontana from 31 December 2024 to 1 January 2025.

-

The firm reported record fee income of $128.2mn in 2024, up 26%.

-

Comments came as universal reported a 4.2 CoR jump to 107.9% in Q4.

-

Hurricane Milton accounted for 60% of the firm’s Q4 large loss tally.

-

The carrier expects the market loss to land at $35bn-40bn.

-

The carrier has paid $1.75bn on around 9,500 claims filed from the wildfires.

-

The conglomerate reported after-tax cat losses of $1.2bn related to Hurricanes Helene and Milton in 2024.

-

Several Florida start-ups are poised to begin writing business this year.

-

The carrier estimated January cat losses of $1.08bn, or $849mn after-tax, including the fires.

-

Wildfire loss ‘serves as a strong reminder not to unwind hard-fought for rates and terms’, the executive said.

-

Total combined losses for the agency’s Helene and Milton estimates stand at $31.8bn.

-

The carrier said 72% of those losses occurred in personal property.

-

A higher loss quantum will put a greater burden on retro programmes.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

Insurers have paid $6.9bn in Southern California wildfire claims in the first four weeks of recovery.

-

The loss aggregator has classified the fires as two separate events for reinsurance purposes.

-

Wildfire is rarely singled out as an exposure that can shift portfolio outcomes.

-

The fall marks this the first time in 20 years the index has been negative in January.

-

More than 33,000 claims had been filed as of 5 February.

-

The firm will match segregated accounts of portfolios to investor mandates.

-

The carrier is “extremely well capitalised” to achieve its strategic ambitions.

-

The insurer disclosed the estimates as it seeks emergency rate hikes from regulators.

-

The company will ‘aggressively pursue subrogation’ for the Eaton Fire.

-

The LA fires ‘demonstrate the magnitude of tail events not well captured in modelling’.

-

Ultimate losses from the Palisades, Eaton and Hurst fires are estimated at $4bn.

-

The LA-based firm estimated gross cat losses in the range of $1.6bn-$2bn.

-

The role at PCS included acting as primary touchpoint for ILS.

-

The carrier’s reinsurance premiums ceded rose by 32% to $3.4bn in 2024.

-

CFP has a $900mn reinsurance attachment point and is still receiving claims daily.

-

The storm is likely to be one of the costliest weather events in Canadian history.

-

AuM remains generally flat at UCITS funds over the weeks since LA fires started.

-

FY24 disclosures show shifting fortunes at reinsurer ILS platforms.

-

Over 2024, four hurricanes added 13 points of cat-loss impact to the combined ratio.

-

But cat bonds are experiencing negative secondary market price movement.

-

The carrier is likely to exceed its Q1 large-loss budget due to the California wildfires.

-

The carrier disclosed it will book $1.1bn in net losses from the California fires.

-

The group ceded 55% more premium to Nephila over the year at $1.3bn.

-

The carrier has been reducing its presence in the state since 2007.

-

The carrier has recognised two separate losses for the Palisades and Eaton fires.

-

The company says the recent wildfires will be the costliest in its history.

-

Programs did not offer adequate risk-adjusted return.

-

Capital inflows, notably into UCITS funds, and accumulated returns supported issuance of $17.2bn in 2024.

-

The Bermudian’s wildfire loss estimate was based on an industry loss range of $35bn-$45bn.

-

A negative January return will be unprecedented for ILS industry.

-

The company’s reinsurance business also has some exposure, the executive said.

-

The index delivered a total return of 1.29% for the month of December.

-

The carrier has around $2.5bn-$4bn of reinsurance cover specifically for California risk.

-

Axis Capital’s fee income from strategic capital partners grew 39% to $85mn in the year to 31 December 2024, up from $61mn the year prior, the firm’s Q4 earnings release said.

-

The bond went on watch after Mercury said it would exceed its $150mn retention.

-

The Floridian also expects to report its “best earnings quarter” for Q4 2024.

-

Models will need to steepen the curve in the tail to reflect severe event frequency.

-

Non-proportional business accounted for 34% of its total.

-

-

The figure does not include specie or auto losses.

-

Secondary pricing on the carrier’s Topanga Re bond partly recovered following the guidance.

-

The carrier also has a $500mn excess $2.4bn aggregate protection.

-

The company received over 10,100 home and auto claims as of January 27.

-

Compared with its initial figure, CatIQ’s latest estimate has increased by 40%.

-

Secondary market pricing indicated anticipated California wildfire losses.

-

Guy Carpenter said personal lines exposure would account for 85% of the aggregate loss.

-

Fitch said 1Q wildfire losses could add 6% to 10% to Mercury’s CoR.

-

The industry loss number has increased threefold from an initial $5bn pick.

-

The total includes fire and smoke damage plus living expenses for evacuees.

-

The fire started Wednesday morning and is currently 0% contained.

-

Total economic losses were $368bn, 14% above the 21st century average.

-

The carrier’s Milton loss came in below expectations, but its fire claims will be “material” in Q1.

-

Losses from the larger fire will amount to $20bn-$25bn, the modeller said.

-

Most carriers paid more in homeowners’ claims than they collected in premiums.

-

Severe convective storms accounted for 41% of last year’s insured loss load.

-

Two 2021 worldwide aggregate ILW notes are also among the markdowns.

-

The carrier can claim separately for the Palisades and Eaton fires if necessary.

-

The carrier has received more than 3,600 claims from LA wildfires.

-

There are many unknown factors including insurance gaps, high-value property and damage to critical infrastructure.

-

The estimate has reduced slightly since the modeler’s last update in October.

-

The fund returned 15.69% in calendar year 2024.

-

The anticipated portion ceded to reinsurance may reach the mid-to-high single-digit billions, it added.

-

This will be the most expensive fire in the state’s history, it said.

-

A $30bn industry loss would use one-third of Big Four’s 2025 cat budgets.

-

ILS managers expect the losses to have some impact on future cat bond spreads.

-

The reinsurance attaches at $7bn, unchanged for the past two years.

-

Sources say the Fair Plan is under-reserved, leading to the possibility of member assessment.

-

The carrier is the largest writer of homeowners’ multi-peril in the state.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

As fires still rage, many fear early $10bn-$20bn estimates were too optimistic.

-

The 2024 loss figure exceeded that of the previous record of C$6.2bn in 2016.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

The index’s performance in November was stronger than the prior year, although YTD returns are behind 2023.

-

Utilities have faced major liabilities for their involvement in starting wildfires.

-

Investigators are homing in on the likely causes of the incidents.

-

The number of structures damaged may put the event on par with the fires of 2017 and 2018.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

Sources say 2025 could be as costly for wildfires as the $20bn-loss years of 2017-18.

-

Total economic and insured losses are “virtually certain” to reach into the billions.

-

AM Best said it expects insured losses from the California wildfires to be “significant”.

-

This could see it surpass the 2017 Camp Fire, which cost around $12.2bn.

-

Plenum said impact is marginal because wildfire contributes only marginally to the risk of bonds.

-

Moody’s also expects losses in the billions of dollars.

-

Six wildfires are now burning in SoCal, with the Palisades fire being the largest.

-

Six fires now cover more than 27,000 acres across Southern California.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

The fast-moving blazes have prompted evacuations across the city.

-

More than 4,000 acres are burning as thousands evacuate.

-

The new agreement provides $40mn of aggregate limit excess of zero.

-

The multi-day weather outbreak caused widespread damage from Texas to the Carolinas.

-

The largest non-US event in 2024 was the catastrophic flooding in Valencia.

-

Cat bonds were a key supply-side driver at 1 January 2025.

-

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

Homeowners’ insurance rates have spiked almost 60% since 2018.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The storms struck Victoria, New South Wales and Queensland.

-

Most of the industry losses occurred in Austria, the Czech Republic and Poland.

-

The company no longer has any exposure to reinsurance contracts.

-

The regulations are part of a state effort to expand wildfire coverage.

-

Overall, reinsurers accepted that rate cuts were still leaving them with strong margins.

-

The reinsurer said investors were interested in expanding after benefiting from good results.

-

The bond will provide multi-peril coverage in the US and District of Columbia.

-

TSR anticipates that next year will see an ACE value of 129 compared with the 30-year norm of 122.

-

The state reinsurer of last resort discussed options for 2025 reinsurance buying strategy.

-

Former ILS investors who left the space have looked again and re-allocated.

-

Losses are concentrated in the states of Baden-Wuerttemberg and Bavaria.

-

It estimated insured losses from nat cats on track to exceed $135bn in 2024.

-

The carrier attributed the intensification of storms this season to climate change.

-

Lloyd’s has taken around 6% of aggregate US hurricane losses in recent years, and disclosed estimated net losses from Helene and Milton of $1.8bn to $3.4bn.

-

Losses from Hurricane Milton are expected to affect only select junior structures.

-

The 2024 hurricane season stayed within predictions for high activity but lacked market-moving events.

-

The Class B notes on the carrier’s debut deal attach at $500mn of losses.

-

Euler ILS Partners and Tropical Storm Risk teamed up to produce an updated version of an earlier study.

-

The bond is split into three tranches of notes.

-

The loss figure has increased 200% from the initial number provided in October.

-

Moderate impacts to ILS returns are anticipated from Hurricane Milton.

-

The association’s Hurricane Beryl net loss stood at $455mn as of 30 September.

-

The estimate includes $102mn from Milton and $114mn Helene development.

-

It is targeting $25mn GWP this year and $50mn GWP in 2025.

-

The floods add to an already historic loss tally for Canada in 2024.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

The ILS unit’s AuM was higher by $100mn compared to $1.9bn as of 30 June.

-

Twia’s SCS losses in Q1-Q3 2024 have been more than double the budgeted amount.

-

The reinsurer took $743mn of nat-cat losses in the quarter.

-

The firm recorded a 13.3% nat cat impact to the P&C combined ratio.

-

Fema's traditional reinsurance programme will attach at losses of $7bn and above.

-

The model factors in the effects of climate change to date.

-

A total of $2.1bn in Fema money has been approved for the state.

-

The reinsurer confirmed its intention to reduce the K-Cession sidecar for 2025.

-

The failure of a Jamaica bond to pay out following Hurricane Beryl damage has brought focus onto the deals.

-

The Florida carrier reported a 103.5% combined ratio in Q3.

-

In other property, Helene and Milton will assure rates remain attractive, he added.

-

The carrier said it expected its Milton losses to fall below its EUR500mn ($537mn) Helene loss.

-

Only around EUR70mn-EUR140mn will fall to private insurers.

-

The firm’s AuM in four key vehicles rose $526mn in Q3.

-

The firm sees a "robust" pipeline of potential investors ahead of the renewals.

-

The Floridian also announced the completion of its first-ever takeout from Florida Citizens.

-

Ceded losses grew by 69.2% in Q3 from the prior year quarter to $44mn.

-

The combined ratio included 17 points of catastrophe losses in the third quarter.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

Most of the losses derive from France.

-

Latest pricing suggests secondary market traders are baking in further loss development.

-

The firm will provide an update on 22 November to avoid holiday season.

-

September was the strongest performing month since the index began in 2006.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

The firm is also integrating changes to its process to allow it to cover wider ground.

-

The commercial carrier also reported a Hurricane Milton pre-tax net loss forecast of $250mn-$300mn.

-

The estimate implies a roughly $15bn homeowners’ industry loss from the hurricane.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

The figures imply first-layer reinsurance recoveries for Helene.

-

The company’s reinsurance premiums ceded fell by 58% to $149mn.

-

The NFIP’s traditional reinsurance coverage kicks in at $7bn of losses.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

Insured losses for 9M 2024 have hit $102bn, according to a report.

-

Liberty Mutual expects $550mn in Helene losses versus Milton’s $250mn-$350mn.

-

The carrier’s estimated pre-tax losses from Milton are $65mn to $110mn.

-

The cyclone pool received $479mn in GWP in the year to 30 June 2024.

-

The carrier is looking at a $600-$900mn hit from Debby, Helene, Milton.

-

Pricing is expected to “stay neutral of soften” for January renewals.

-

The Floridian anticipates Hurricanes Debby and Helene to incur losses of $3.8mn in Q3 2024.

-

The firm still expects to deliver positive net income for Q3 2024.

-

Assuming Munich Re takes roughly a 3% market share of hurricane losses suggests a ~$20bn industry loss for Helene.

-

As a result of mostly flooding, £495mn ($644mn) of losses occurred in the UK.

-

Managers expect Hurricane Milton losses to shore up pricing.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

Losses from the hurricane may not significantly impact on many funds’ annual returns.

-

Earlier this week, RMS estimated insured losses for Helene and Milton at $35bn-$55bn.

-

Florida domestics, aggregate retro and flood deals were all marked down.

-

The catastrophe loss estimate for September totalled $889mn, pre-tax.

-

HCI is estimated to incur a net expense of $125mn for Milton in Q4 2024.

-

Most of the insured loss was attributable to wind.

-

Icosa said certain cat bonds could see more than 0.2 points of price movement.

-

Twia filed for the rate hike in August after an actuarial analysis showed that rates were inadequate.

-

The company incurred $563mn of total cat losses related to the storm.

-

The bulls expect around $20bn-$30bn in Milton losses, with the bears anticipating $40bn-$50bn.

-

The estimate includes private cover for residential, commercial and industrial property.

-

RMS will issue its final loss estimates for Milton later this week.

-

Plenum said wind damage from Milton could lead to “moderate” losses for its cat-bond funds.

-

Hurricane Milton will show the ILS product behaving as investors expect it to.

-

The company is monitoring the NFIP’s flood-exposed bonds.

-

This is a far narrower drop than post Ian, when the index was lost 10%.

-

A client presentation from the broker put total insured losses at $25bn-$40bn, leaving the Citizens and the National Flood Insurance Programs clear of reinsurance impacts.

-

Milton made landfall near Siesta Key yesterday, leaving 2.7 million homes without power.

-

Losses to the NFIP-sponsored cat bonds remains a key area of uncertainty, the investment manager reported.

-

A $40bn Milton loss should barely dent many ILS returns but will trap some capital.

-

On Wednesday, the model had suggested a mean figure at $25.3bn.

-

The hurricane is likely to prevent rate reductions in property cat in 2025.

-

The event has spared (re)insurers the more extreme scenarios that were under discussion earlier this week.

-

Milton made landfall south of Tampa Bay at Category 3 on Wednesday night.

-

This is based on insured loss estimates of between $20bn and $60bn.

-

The pre-landfall figures are not an official loss estimate from the modeller.

-

The hurricane has destroyed hundreds of homes and left more than 2.7 million homes without power in Florida.

-

Milton’s center is projected to make landfall near or just south of Tampa Bay.

-

Integrity Re 2024-D and Lightning Re 2023-1A are two bonds that were marked down, although no trading has occurred.

-

The NHC storm track predicts landfall below Sarasota, south of Tampa Bay.

-

Hurricane Milton’s overall impact, based on the current pre-landfall scenario, could lead to “moderate losses” for Plenum’s funds.

-

Collateralised reinsurance and retro are in the firing line.

-

The government-backed scheme has greater take-up in areas in Milton’s path.

-

Restrengthening to Category 5 is still possible, Siffert warns.

-

Earlier this week, Moody’s RMS Event Response estimated the event would cost $8bn-$14bn.

-

Prior forecasts indicated a more northward track towards Tampa Bay and St Petersburg.

-

The storm is now predicted to make landfall south of Tampa Bay.

-

The NHC is predicting storm surge, exacerbated by the tide, as high as 15 ft for Tampa Bay.

-

The Mexican cat bond offers $125mn of protection against Atlantic named storms.

-

A hurricane warning has been issued for the east coast of Florida.

-

Most sources noted expectations of a $50bn+ event, but the range of outcomes is huge.

-

Hurricane Milton strengthened from a tropical storm on Sunday to a Category 5 storm yesterday.

-

Destructive storm surge is expected along Florida’s West Coast on Wednesday.

-

The panelists discussed the ILS reset and the path to maintaining discipline in this sector.

-

Moody’s also predicts losses to the NFIP at potentially more than $2bn.

-

The storm is packing maximum sustained winds of 175mph.

-

Milton is expected to move north of the Yucatan Peninsula today and cross the eastern Gulf of Mexico by Wednesday.

-

Parts of the Yucatan peninsula are under a hurricane warning, though the storm is expected to remain offshore.

-

The NFIP’s losses are estimated at $4.5bn-$6.5bn.

-

Experts have raised concerns over significant rainfall, record-setting storm surge and lingering Hurricane Helene debris.

-

The “exceptionally large and powerful” Category 4 storm made landfall in Florida last month.

-

Rising sea levels and ocean warming were likely factors in Helene’s strength.

-

The figure does not include NFIP losses.

-

Most of the estimated insured losses will be retained by insurers.

-

The loss estimate covers Czechia, Poland and Austria.

-

Key floods this year outside of the US include the Rio Grande do Sul.

-

The biggest limitation to growth is supply, given ILS capital “reticence” after the 2016-22 years.

-

Praedicat CEO Bob Reville outlined the firm’s approach to "casualty cat" as liability risk modeling continues to mature.

-

The numbers will be refined further to arrive at an industry loss estimate.

-

Moody’s described Hurricane Helene as “like Idalia but worse”.

-

The storm made landfall as a major hurricane in Florida’s Big Bend region.

-

The ratings agency expects insured losses of around $5bn for Helene.

-

The manager is hopeful of closing all contracts by the end of 2024.

-

Tallahassee avoided a major hit – but flood and storm-surge losses remain unknown.

-

The NFIP has a higher take-up rate in Tampa Bay, which experienced record coastal storm surge.

-

Helene is expected to become a post-tropical low later today.

-

Aon estimated losses for the Czech Republic at EUR775mn, Austria EUR555mn, Poland EUR285mn and Slovakia EUR33mn.

-

More than one million Floridians are without power after the storm hit.

-

Additional strengthening is expected before Helene makes landfall in Florida tonight.

-

Only three storms have impacted a larger area than Helene since 1998.

-

An unexpected shift east towards Tampa could push losses beyond $10bn.

-

TSR predicts Atlanta, Georgia, could face Cat 1 windspeeds as the storm moves further inland.

-

The storm is expected to make landfall in Florida’s Big Bend coast on Thursday evening.

-

Helene is currently a Category 1, but rapid strengthening is anticipated over the next day.

-

The ILS manager expects “minimal, if any, losses” to bonds in its funds.

-

In the best-case scenario, a Big Bend-landing storm could cost $3bn-$5bn, Howden Re said.

-

A hurricane warning is in effect from the Anclote River to Mexico Beach, Florida.

-

A storm surge warning is in effect from Flamingo to Indian Pass.

-

The storm could become a major hurricane by Thursday.

-

July and August floods and fires caused the bulk of the insured loss burden.

-

Severe convective storms accounted for 60% of H1 global cat losses.

-

The system is forming in the same area as 2022’s Hurricane Ian.

-

The ETF format provides for publication of a daily NAV.

-

Fifteen events caused estimated losses of $306mn.

-

Floir approved nearly 650,000 policies for takeout from Citizens for October and November.

-

The broker replaces Goldman Sachs on the business after the bank ceased offering ILS services.

-

Moody’s also predicts losses to the NFIP at less than $200mn.

-

The effort will draw from California’s research and higher education communities.

-

The estimate is like others in the market, suggesting a relatively small loss from the event.

-

The hurricane has led to a “surge” in insurance claims related to floods, according to the IBC.

-

The ratings agency said companies focused on growing business in Gulf Coast states, however, would face a “key test” as claims materialised.

-

A sub-$3bn industry insured loss event would be similar to estimates for hurricanes Beryl and Debby.

-

Francine has been the eighth Category 2 or larger storm to make landfall in Louisiana since 2000.

-

The sponsor has kept $25mn of principal in extension for any further loss development.

-

The storm is expected to weaken to a post-tropical cyclone later tonight.

-

Kin’s reinsurance structuring means the bond’s losses will be kept to a minimum.

-

‘Life-threatening’ storm surge and hurricane-force winds expected for the state, according to the NHC.

-

Francine is expected to make landfall in Louisiana tomorrow.

-

The estimate from the Perils-owned company does not include any losses from Hurricane Debby.

-

A hurricane watch is now in effect for the Louisiana coastline.

-

Most of the ILS capital was attracted to the cat bond market.

-

Cat bond funds continue to draw interest as private ILS more challenged.

-

Some Canadian cedants have approached the market for top-up cover.

-

The loss has increased by 1.4% since the company’s first assessment.

-

The transaction complements its previous acquisition of RMS in 2021.

-

The broker said it expects strong ILS capital inflows to continue.

-

-

Urban expansion, climate change and inflation are key drivers of losses.

-

The rate change will be implemented in November.

-

The Insurance Bureau of Canada said the blaze damaged one-third of the Jasper community.

-

The P&C Re CoR came in at 84.5%, a 10.2-point YoY improvement.

-

The CEA has $326.4mn towards risk transfer, 44% below budget.

-

Leadenhall first filed its lawsuit against 777 Partners in May this year.

-

Data shows that nat cat losses in Canada have increased substantially this century.

-

Returns were down on 2023, which benefited from favourable Ian loss development.

-

The regulations have been officially published online, with a hearing to be held next month.

-

Rising premium income is not keeping pace with the increased cost of claims.

-

The storm made landfall on Saturday as a Category 1 hurricane.

-

Ernesto’s maximum sustained winds have reached 100 mph.

-

Total catastrophe losses stemmed from 20 events and were estimated at $587mn.

-

-

Flights cancelled as typhoon ramps up to Cat 4.

-

Ernesto is expected to track past Bermuda on Saturday with hurricane conditions.

-

Moody’s also predicts losses to the NFIP at less than $300mn.

-

The peril can no longer be considered secondary, according to Gallagher Re.

-

Both groups continue to call for a highly active season, however.

-

Several bonds suffered declines in value from February to July.

-

Debby should be a “very manageable” storm for the (re)insurance market, it said.

-

Subsidiaries Core and Typtap have applied to participate in the November Citizens policies assumption.

-

The storm brought a lot of rain, but the Floridian doesn’t provide flood insurance.

-

The loss is based on modelled outputs, as opposed to an initial loss estimate.

-

The board of directors has voted for a 10% rate hike.

-

Fee income at the Re & ILS division grew by 58% to $44.3mn in H1.

-

Severe thunderstorms, mainly in the US, accounted for 70% of insured losses globally.

-

Its forecast for intense hurricanes is unchanged at six.

-

The NHC has said there is potential for “historic heavy rainfall” across southeast Georgia and South Carolina.

-

It consisted of three major earthquakes within a nine-hour period on 6 February 2023.

-

Geico more than tripled underwriting profits.

-

The ‘life threatening’ hurricane has potential for “historic heavy rainfall” in the southeastern United States.

-

The broker said less than 1% of companies globally with cyber insurance were impacted.

-

The insurer said once firms give up lower attachments or aggregates they “simply do not get them back”.

-

Over 75% of insured losses attributable to severe thunderstorms, flooding and forest fires.

-

The firm also posted a 56% increase in fee income.

-

Losses from mid-sized nat cats added 9.9 points to the P&C combined ratio.

-

The firm said losses could fall under $300mn if more favourable assumptions were applied.

-

The property market remains “one of the most favorable ... I've seen in my career,” the executive said.

-

The event would represent a loss ratio impact of roughly 3%-10% on global cyber premiums of $15bn today.

-

The weighted average direct financial loss for a Fortune 500 firm was $44mn.

-

The current guidance is that Beazley will publish an undiscounted CoR in the low-80s at full year.

-

The carrier purchased an additional $150mn of cover.

-

The modeller said 3 million homes were without power at its peak.

-

The figure is well above the historical average of $39bn for this century.

-

Allstate’s total pre-tax cat losses for H1 2024 were $2.85bn versus an estimated $4.39bn in H1 2023.

-

Most of the losses occurred in Bavaria and Baden-Wuerttemberg.

-

The biggest losses were from wind damage after the storm’s Texas landfall.

-

Relentless focus on annual outcomes provides a packaging that doesn’t fit the purpose.

-

Uncertainty around the quantum remains due to policy deductible variation.

-

The insured loss from Beryl in the US was pegged at $2.7bn.

-

Industry losses of $800mn-$1.2bn are expected from Beryl's impact in Texas.

-

Hurricane Beryl was a “harbinger of a hyperactive season,” CSU said.

-

Chief science officer Steve Bowen said it was still too early to provide precise insured-loss estimates.

-

Secondary market activity and hedging would be likely if a Beryl-sized storm tracked toward the US.

-

Houston mayor John Whitmire said: “We woke up this morning on the dirty side of a dirty hurricane.”

-

Beryl has been downgraded to a tropical storm but is still life-threatening, with news media reporting two deaths so far.

-

Sources said that Japanese big-three carrier Sompo and Italian insurance giant Generali are circling.

-

Availability of ILS has so far fulfilled investor demand.

-

The latest Insider ILS Outstanding Contributor for the year said 2011 was an under-appreciated turning point for the market.

-

According to BMS, Hurricane Beryl is likely to be a retained event for most insurance carriers.

-

Insured losses could be less than $1bn if current NHC forecasts are accurate.

-

The forecast comes following the earliest Category 5 storm on record.

-

The parametric trigger on the World Bank deal specifies storm pressure of 955mb or lower but its initial reported landfall was at 975mb.

-

Hurricane Beryl is expected to strengthen again after hitting the Yucatan Peninsula.

-

The parametric structure would have paid out at slightly lower storm pressure.

-

The storm destroyed housing in St Vincent and the Grenadines and Grenada.

-

The storm is predicted to hit the Caymans tonight or early Thursday.

-

Recent modelling predicts a strong probability of direct landfall in Jamaica.

-

Grenada and St Vincent were spared the full brunt of the storm.

-

Hurricane conditions are expected in Jamaica on Wednesday, according to the NHC.

-

Aggregated losses are likely to be around the long-term H1 average of $8.5bn.

-

-

Cat bond spreads stabilised as maturities brought capital to deploy into the market, after an earlier spike.

-

Grenada and St Vincent and the Grenadines are under the most threat from the storm.

-

The broker estimated ILS capacity reached a record $107bn as cat bond interest surged.

-

The estimate is up from A$1.5bn, published by Perils in April.

-

The broker said high ILS maturities would boost cat bond issuance though the hurricane season would impact capital availability.

-

Berkshire Hathaway and Canada Life Re will provide as much as A$680mn of protection annually.

-

The Gallagher executive called it a “relentless start to the year”.

-

The model uses machine learning and daily data to forecast hurricane seasons.

-

Riots erupted in the Pacific Island territory last month over electoral reforms.

-

The claims tally has increased 7% since the last estimate a month ago.

-

ILS capital so far is viewed by sponsors as strategic rather than essential.

-

Tropical Storm Alberto, the first named storm of this year’s Atlantic hurricane season, made landfall this morning over Mexico and Texas, bringing heavy winds and gusty rains, according to the US National Hurricane Center (NHC).

-

This takes pre-tax year-to-date cat losses to $2.62bn.

-

Alberto is the first named storm of this year’s hurricane season.

-

Loss estimates are coming in for the weather event in Bavaria and Baden-Württemberg.

-

A degree of pricing volatility was evident in the market this week.

-

Torrential rain caused flash floods in the Gulf States in the middle of April.

-

The firm is the sole provider to offer index services in the US.

-

The losses added 12.3 points to the firm's 100.4% CoR.

-

The loss follows the pattern of 2002 and 2013 European flooding.

-

Reinsurers “weren’t getting paid” before 2023’s hardening, the Lloyd’s executive argued.

-

Reinsurers scaled back their coverage to non-peak events in 2023.

-

The research body initially warned of an active storm season in April.

-

Reinsurers are much better placed to absorb cat losses; insurers are carrying more risk.

-

Sub-1% management fee and performance fee-only structures have evolved in ILS.

-

The ratings agency noted robust profit margins for reinsurers.

-

Europe has experienced an uptick of insured losses from severe weather.

-

The Italian hailstorm event in the summer 2023 saw estimated losses nearly triple.

-

-

This compares to the 2023-2024 tower which covered losses up to $2.83bn.

-

The firm now predicts six major hurricanes and 24 tropical storms.

-

Additional capacity for upper-layer coverage is driving rate reductions, the broker says.

-

Forecasters have warned that a number of meteorological factors could make this year the most active on record.

-

The company increased its full year 2024 adjusted net income guidance.

-

Most years since 2014 have seen at least one named storm before 1 June.

-

Sources said that while a late June-early July IPO is still on the table, a Q4 or early 2025 listing is expected.

-

Concerning hurricane forecasts are among the factors driving tighter reinsurer capacity.

-

The outlook calls for an 85% chance of an above-normal season.

-

The program includes all perils coverage and third-event protection.

-

The total economic cost from the catastrophe is estimated to be EUR9bn.

-

This takes pre-tax cat losses for the calendar year to $1.23bn

-

P&C re and CorSo reported improved net profits and combined ratios for the quarter.

-

The ratings agency warns that wildfire is an increasingly risky and unpredictable peril.

-

The carrier experienced a benign Q1 for catastrophic loss activity.

-

Large losses came to EUR52mn with low retro recoveries.

-

Storms struck the Great Plains, the Midwest and the Southeast.

-

Cession ratios declined at three of the four publicly listed Floridians.

-

The carrier also reported a $16mn satellite loss during the quarter.

-

The company plans to reduce its quota share to 20% from 40%.

-

Rates are still materially higher than pre-pandemic and lower layers are holding firmer.

-

The carrier reported a P&C re net result up 44% to EUR1.8bn.

-

-

The firm expects pricing and terms and conditions to hold.

-

The firm’s ILS unit expanded fee income by 10% over Q1 2023.

-

First event tower for the Northeast exhausts at $1.1bn, at $1.3bn for Southeast and $750mn in Hawaii.

-

Overall economic losses hit $45bn in the first quarter of 2024.

-

Various trends may work together to hold the cat markets up for longer than some had feared.

-

State interference is likely to be required if an attack is large enough to trigger bonds now on the market, experts say.

-

Its Class 13 and 14 notes priced roughly at the midpoint of expectations.

-

Panellists at the Insurance Insider ILS conference say forecasts can push capital to “the edges” of the market.

-

The awards event will be held on 27 June at The HAC, London.

-

Increased ILW purchasing reflects cash-rich funds looking to protect return levels.

-

As a result of mostly flooding, £474mn of losses occurred in the UK.

-

Researchers expect 15-20 named storms to form in the Atlantic Basin.

-

This follows February’s cat losses coming in below the $150mn reporting threshold.

-

Insured loss for Q1 was 10% higher than the decadal average of $18bn.

-

Managers have tightened buffer terms and added extension spreads to enhance illiquid strategies.

-

The most extensive damage was caused by rainfall in Texas, Louisiana, Mississippi and Florida.

-

Sums insured for European windstorm increased by 10.1% due to inflation.

-

Tropical Storm Risk (TSR) has updated its forecast for North Atlantic hurricane activity, predicting a "hyper-active season" in 2024, with activity being around 70% above the 1991-2020 climate norm.

-

Retained earnings resulting from reduced loss activity also helped to boost ILS capital.

-

The syndicate snatched the number one spot from Chaucer’s Syndicate 1176.

-

The Magnitude-7.4 earthquake occurred early on 3 April.

-

Eleven hurricanes are predicted, with five expected to reach Category 3 or higher.

-

FHCF rates are also projected to decrease by a statewide average of 7.38%.

-

Tremors were felt as far north as capital city Taipei.

-

The partnership seeks to serve corporates with captives, Lloyd’s syndicates and ILS funds.

-

The estimate is up from A$1.4bn, published by Perils in February.

-

The cover will be triggered on an indemnity, annual aggregate basis.

-

Several prior-year cat losses deteriorated during the quarter.

-

Sources said the deal was roughly three times over-subscribed as cat becomes hot.

-

The carrier closed its Sussex Diversified Fund in October last year.

-

The carrier’s non-life combined ratio improved by 5 points to 81.6%.

-

Severe convective storms were the biggest driver of last year’s losses.

-

He will oversee the syndicate’s catastrophe modelling capabilities.

-

The body’s budget committee is again pressing Citizens over solvency concerns.

-

This follows January pre-tax cat losses of $276mn.

-

The RfP covers the CEA and/or the California Wildfire Fund.

-

The reinsurer’s large losses were down 5% to EUR1.6bn for the year.

-

Sources are expecting multi-billion new limit to be placed.

-

Some $415mn of capacity entered the market last year.

-

Estimates were revised from $845mn to $740mn.

-

-

Sabine Re marks Allied Trust’s entry to the market.

-

-

The firm’s assets under management dropped to $1.6bn, as a capital return more than offset new inflows.

-

Exposure updates played a greater role than expected.

-

The closing of the Interboro sell-off was postponed to nearer the end of the year.

-

Insured loss estimates are not yet available.

-

Sources said preparations for a 2024 IPO were halted, but work could resume later this year.

-

The US tallies $97bn in economic losses from major perils each year.

-

Munich Re said it saw no reason to lower its expectations.

-

The vast majority of 2023 recoveries were from events in prior years.

-

The vulnerability updates are the biggest driver of loss changes.

-

The notes were further marked down after a year-end Ian loss update.

-

The outlook for M&A activity is brighter after 2023 returns.

-

The event occurred a fortnight after major North Island flooding in New Zealand.

-

The reinsurer’s assets under management rose 14% to $3.3bn.

-

Monthly cat losses were driven by two major events.

-

The bond is trading at 70c-75c in the dollar in the secondary market.

-

There were 10 fatalities, mostly due to drowning or tree fall accidents.

-

The carriers were in arbitration with UnipolRe and Gen Re.

-

Aside from the one-year view, 2023 remixes the track record.

-

The newly launched Marco Re will be led by Mark Elliott as CEO.

-

The carrier booked a reserve charge of $392mn for casualty insurance.

-

The manager’s conservative strategy posted returns of 7.61%.

-

The claw-back is anticipated after PCS revised down its Ian loss estimate.

-

-

A so-called atmospheric river effect is behind the severe weather.

-

The figure represents a 26% increase on the previous estimate.

-

Most of the losses occurred in France, followed by the UK and Belgium.

-

The final estimate is a 12% increase on an August tally of NZ$1.99bn.

-

The fund manager operations booked management fees of $31mn.

-

The Bermudian said its third-party vehicles were “sufficiently capitalised”.

-

The increase can be attributed to the Christmas storms of 2023.

-

Storm Ciarán incurred insured losses of EUR1.9bn, according to WTW’s natural catastrophe report for July to December.

-

Typical ILW attachment points for US peak perils have fallen from $60bn to $40bn-$50bn as the market awaits the final Hurricane Ian number from PCS.

-

The Insurance Council of Australia has estimated A$743mn ($489.6mn) of insured losses from Tropical Cyclone Jasper and the Christmas and New Year storms.

-

The broker’s latest climate report tallied global insured cat losses at $118bn.

-

As a result of mostly flooding, £467mn of losses occurred in the UK.

-

Unfavorable prior year reserve re-estimates, excluding catastrophes, totaled $199mn in Q4, with approximately $148mn related to personal auto, including costs for litigation claims.

-

2023 was the fourth consecutive year insured cat losses surpassed $100bn.

-

The sixth edition of the sidecar reflected alignment of interest with long-term partners, the reinsurer said.

-

Cat bonds and sidecars are well positioned for growth, while private ILS will benefit from further innovations to improve liquidity.

-

In its semi-annual report for the six months to 31 July 2023, the manager said the fund had returned 2.74% over the half-year.

-

More than three-quarters of the losses came from the firm’s UK&I line of business.

-

Wind and tornado in the US may already have led to losses in the hundreds of millions, according to Aon’s report.

-

The loss estimate includes property damage, contents and BI insurance across residential, commercial and industrial lines.

-

In total, insurers paid indemnity of $11bn and loss adjustment expenses of $1.5bn for claims closed in 2022.

-

The independent manager’s post-Ian growth has helped it more than double from prior estimated assets under management.

-

The Swiss Re Total Return Index climbed month-over-month throughout the year, to more than regain ground lost after Hurricane Ian in September 2022.

-

The scale of the claim is expected to be just within the expected total weather losses for insurers.

-

The figure does not include losses from the likes of infrastructure, automobiles and business interruption.

-

The year was characterised by several severe and costly thunderstorms.

-

The performance continues an unbroken run of positive monthly returns in 2023.

-

While it is too early to determine the total financial loss, the US Geological Survey believes there is a 64% likelihood it will reach into the billions of US dollars.

-

The broker’s report also hailed the best risk-adjusted margins for ILS investors in a decade.

-

The insurer said it has received 19,000 claims from affected policyholders so far, with nearly 65% of these coming from customers in Queensland.

-

In total there were seven international events that exceeded $1bn in 2023.

-

The broker said global cat rates rose 3% in the 1 January reinsurance renewals.