-

Idalia is likely to be a hurricane while moving across southern Georgia and possibly when it reaches the coast of Georgia, according to the latest NHC update.

-

The forecaster also added a tropical storm watch for parts of North Carolina.

-

If the storm steers clear of Tampa, reinsurers will be well placed for minimal losses, but a retention loss is a further blow for weak Floridians.

-

Hurricane Idalia will reach Jacksonville but will have weakened by then

-

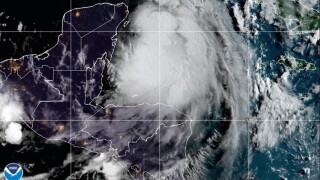

The storm is set to become an “extremely dangerous major hurricane” by landfall on Wednesday.

-

Idalia is forecast to become a hurricane later today and a dangerous major hurricane over the northeastern Gulf of Mexico by early Wednesday.

-

A major hurricane in any section of Florida that extends into the Southeast states is likely a “multi-billion-dollar” insurance industry event, according to the broker.

-

The storm is now forecast to become a major hurricane by Tuesday night. This morning’s advisory update had estimated that Idalia would reach major hurricane status by early Wednesday.

-

The estimate includes privately insured damage to residential, commercial and industrial property, as well as automobiles. Boats, offshore properties and NFIP losses were excluded.

-

The broker said economic uncertainty, climate risk and inflation were challenges for the industry.

-

Idalia is forecast to become a hurricane later today and a dangerous major hurricane over the northeastern Gulf of Mexico by early Wednesday.

-

For insurers, the Golden State is one of the last places they want to face disputes or lawsuits with consumers.